Fuel Economics at Sea: How Route Choice Impacts Voyage Profitability

In global maritime logistics, the choice between the Suez Canal and the Cape of Good Hope represents a strategic decision that significantly influences operational costs, voyage efficiency, and market competitiveness. For crude oil tanker operators, determining the optimal route involves a complex balance between economics, safety, and time management.

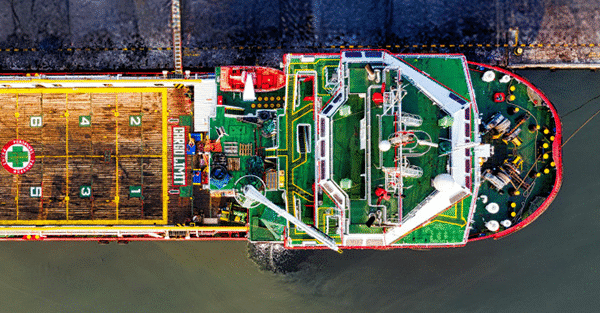

At Karimar Ship, our expertise in ship management and maritime services allows us to examine this choice through a practical, data-driven lens understanding not only cost structures but also the broader operational implications that affect global trade performance.

- Cost of Transit

The Suez Canal, spanning 193 kilometers, charges tolls that can range from $30,000 to $450,000, depending on vessel size and cargo type. The Cape of Good Hope, by contrast, has no direct toll fees, making it initially more appealing. However, the added fuel consumption and extended sailing time often increasing expenses by $50,000 to $100,000 may offset these savings.

In practice, Karimar Ship’s analytical approach to voyage cost modeling highlights that real efficiency is not about minimizing one-time tolls, but about optimizing the total cost per nautical mile, taking into account time, fuel, and reliability.

- Voyage Duration and Time Sensitivity

The Suez Canal route reduces transit time by 7–10 days compared to the Cape route. For crude oil traders and operators, shorter voyages mean faster deliveries, lower demurrage, and greater responsiveness to volatile markets.

Conversely, the Cape route’s extended duration increases exposure to unpredictable weather patterns, which can lead to costly delays. Karimar Ship’s route optimization systems help clients navigate these trade-offs with precision ensuring that time-sensitive cargoes are transported via the most efficient path available.

- Operational and Maintenance Costs

Longer voyages around the Cape inherently increase engine wear, maintenance cycles, and crew costs. Shorter Suez passages can help reduce mechanical stress and extend asset lifespan, which directly contributes to lower long-term operating costs.

Through its technical management and performance monitoring solutions, Karimar Ship supports operators in minimizing maintenance-related expenses, ensuring vessels operate at peak efficiency regardless of route choice.

- Environmental and Insurance Costs

While the Cape route avoids canal congestion, it passes through regions with higher piracy risks leading to increased insurance premiums and the need for heightened security measures. The Suez Canal, though safer, carries its own environmental considerations, such as higher carbon intensity per transit due to queue times and maneuvering.

Karimar Ship advocates for sustainability-driven route planning, integrating environmental impact assessments into voyage strategies to meet global ESG and IMO 2030 standards.

- Market Conditions and Flexibility

Route selection is not purely a financial decision it’s also about adaptability. During geopolitical tensions or Red Sea disruptions, rerouting around the Cape may be necessary despite added costs. Conversely, when stability returns, the Suez Canal regains its advantage in efficiency and connectivity.

Karimar Ship’s market intelligence and voyage advisory services empower clients to adjust swiftly to these changing conditions, balancing cost-efficiency with strategic foresight.

Conclusion

Choosing between the Suez Canal and the Cape of Good Hope is not merely a question of tolls versus distance it’s a strategic decision shaped by economic, operational, and environmental factors.